by admin | Sep 25, 2025 | Reviews & Recommendations, Book Lists

Introduction

If you’ve ever struggled with debt or felt like your money is controlling you, you’ve probably heard of The Total Money Makeover by Dave Ramsey. It’s one of the most popular personal finance books in the world, selling millions of copies and inspiring countless people to get out of debt and build wealth.

In this post, I’ll share my honest review of the book, what I loved, what I didn’t agree with, and the key lessons you can apply right away.

What is The Total Money Makeover About?

The book is built around Dave Ramsey’s 7 Baby Steps — a simple plan to take control of your money, pay off debt, and build wealth. Ramsey’s philosophy is based on living debt-free, budgeting every dollar, and building long-term financial security.

The 7 Baby Steps (Key Lessons)

1. Save $1,000 for a Starter Emergency Fund

Life happens—cars break down, medical bills pop up. Ramsey emphasizes starting with a $1,000 safety net to avoid going further into debt.

👉 Takeaway: Even if you’re starting small, having a cushion helps you feel more in control.

2. Pay Off All Debt (Except the House) Using the Debt Snowball

Ramsey is famous for the debt snowball method: paying off your smallest debts first, then rolling that payment into the next largest. This builds momentum and motivation.

👉 Takeaway: This method focuses on behavior, not math—and it works for most people who need quick wins.

3. Build a Fully Funded Emergency Fund (3–6 Months of Expenses)

Once debt is gone, Ramsey advises saving enough to cover 3–6 months of expenses. This protects you from life’s bigger surprises like job loss or health issues.

👉 Takeaway: Peace of mind is priceless—this is your safety net.

4. Invest 15% of Income in Retirement Accounts

Ramsey encourages investing consistently in retirement accounts like 401(k)s and IRAs.

👉 Takeaway: Start early, invest consistently, and let compounding work for you.

5. Save for Your Children’s College Fund

If you have kids, Ramsey suggests preparing for their future to help them avoid student debt.

👉 Takeaway: Even small, consistent savings for education add up over time.

6. Pay Off Your Home Early

Ramsey is firmly anti-debt—even for mortgages. He suggests working to pay off your house as soon as possible.

👉 Takeaway: Imagine the freedom of owning your home outright.

7. Build Wealth and Give Generously

The final step: once you’re debt-free and financially secure, focus on building wealth and giving back to others.

👉 Takeaway: Financial freedom isn’t just about security—it’s about generosity.

What I Liked About the Book

✅ Clear, step-by-step plan (no confusion).

✅ Motivating real-life success stories.

✅ Focuses on behavior, not just numbers.

What I Didn’t Agree With

❌ Ramsey discourages almost all credit card use—even for those who can manage responsibly.

❌ His investment advice is basic and doesn’t dive deep into diversification.

❌ Some may find his tone too strict.

Who Should Read This Book?

This book is perfect if you are:

- Struggling with debt and need a simple, proven plan

- Looking for motivation and accountability

- A beginner in personal finance who feels overwhelmed

If you’re already advanced in investing or debt-free, you may find the book too basic—but it’s still inspiring.

Final Verdict

The Total Money Makeover is one of the best personal finance books for beginners. While you don’t have to follow every rule to the letter, the 7 Baby Steps provide a solid foundation for financial health.

👉 My Rating: ⭐⭐⭐⭐☆ (4/5)

👉 Worth reading if you want to start your debt-free journey today.

by admin | Apr 20, 2025 | Budgeting & Money, Budgeting Tips

Introduction

Struggling to keep track of your income and expenses? A budget tracker is a simple yet powerful tool that can help you stay on top of your finances. In this post, I’m sharing a free printable budget tracker that you can download and start using today!

Why Use a Budget Tracker?

A budget tracker helps you:

- Understand where your money is going

- Avoid overspending

- Achieve your savings goals

- Stay organized with your monthly bills and expenses

Whether you’re budgeting weekly or monthly, having everything written down keeps you accountable and aware.

What’s Inside the Free Printable?

This printable includes:

- Income tracker

- Fixed & variable expenses

- Savings goals

- Notes section

It’s minimal, clean, and designed to keep your financial life tidy—just like The Tidy Leaf brand!

How to Use the Budget Tracker

- Download and print the PDF version

- Fill in your monthly income and expected expenses

- Track daily spending in the expense section

- At month’s end, review and adjust

💾 Download Your Free Printable

Click the link below to get instant access to your free budget tracker printable:

👉 Download Printable Budget Tracker (PDF)

👉 Personal Expense Tracker Online

No sign-up needed. Just print and go!

Tips for Budgeting Success

- Be consistent and honest with your entries

- Review your budget weekly

- Cut back on unnecessary subscriptions

- Set small savings goals to stay motivated

Final Thoughts

Budgeting doesn’t have to be stressful. With this simple printable tracker, you can take control of your money and build better habits—one day at a time.

Happy budgeting! 🧾💚

by admin | Apr 20, 2025 | Budgeting & Money, Saving Challenges

Introduction

Overspending was a habit I didn’t realize I had until I took a closer look at my finances. From small daily purchases to big-ticket items, it all added up. Here’s how I stopped overspending and started saving with simple, yet effective steps.

Step 1: Recognizing the Problem

I noticed that I was spending more than I realized, especially on subscriptions and unnecessary purchases. Recognizing the problem was the first step toward fixing it. It’s essential to track where your money goes to understand how much you’re actually spending.

Step 2: Tracking My Expenses

I started using a budget app to log every transaction. This gave me a clear picture of my spending habits and highlighted areas where I could cut back, like eating out or impulse buys.

Check out our Budgeting Tips.

Step 3: Creating a Simple Budget

With my expenses tracked, I created a simple budget. I allocated a set amount for essential expenses and savings each month. I used a budgeting app to keep me on track, which made managing my finances much easier.

Step 4: Cutting Back on Unnecessary Purchases

I reviewed my spending and canceled unused subscriptions, cooked at home more, and stopped making impulse buys. I found that cutting back on these small, non-essential expenses helped me save more.

Step 5: Setting Saving Goals

Setting clear savings goals was key. I aimed to save a set percentage of my income each month for things like an emergency fund and future goals. Having a goal helped me stay motivated.

Step 6: Automating My Savings

I set up automatic transfers to my savings account. This was a game-changer because I didn’t have to think about saving—it just happened. This consistency made a huge impact over time.

Use a budgeting app to track expenses: Mint

Conclusion

By recognizing the problem, tracking my spending, and setting clear goals, I was able to stop overspending and start saving. The process wasn’t hard, but it required focus and discipline. I’m now more in control of my finances, and the results have been rewarding.

by admin | Apr 20, 2025 | Budgeting & Money, Budgeting Tips

Introduction:

Starting your budgeting journey can be both exciting and intimidating. The promise of financial control is motivating, but it’s easy to stumble into common traps. If you’re new to budgeting, don’t worry—we’ve all made these mistakes. Here are five things to watch out for and how you can steer clear of them.

1. Setting Unrealistic Goals

Many beginners make the mistake of creating overly ambitious budgets. Cutting your grocery spending in half overnight or planning to save 70% of your income may not be sustainable. Start with small, achievable goals that motivate rather than overwhelm you.

👉 Tip: Track your spending for a month before setting targets.

2. Forgetting Irregular Expenses

It’s easy to plan for rent, groceries, and utilities—but what about birthdays, holidays, car maintenance, or yearly subscriptions? These can wreck your budget if not planned for.

👉 Tip: Create a “sinking fund” category for such irregular but expected expenses.

3. Not Tracking Spending

Creating a budget isn’t enough—you need to check in regularly. Many people set their monthly plan and then forget to track if they’re sticking to it.

👉 Tip: Use free budgeting apps like Mint to automatically track expenses (nofollow, open in new tab).

4. Ignoring Emergency Funds

Without an emergency fund, a flat tire or medical bill can send you into debt. Many beginners overlook this critical part of financial planning.

👉 Tip: Start with a $500–$1000 goal and grow it over time.

5. Giving Up After One Bad Month

Budgeting is a learning process. You’ll overspend, forget things, or make adjustments—and that’s okay. The key is to stay consistent and learn from each month’s results.

👉 Tip: Review your budget monthly and celebrate small wins.

Conclusion:

Budgeting isn’t about perfection—it’s about progress. By avoiding these beginner mistakes, you’ll set yourself up for long-term success and financial peace of mind. Keep learning, keep adjusting, and don’t forget to be kind to yourself in the process.

by admin | Apr 20, 2025 | Budgeting & Money

Introduction

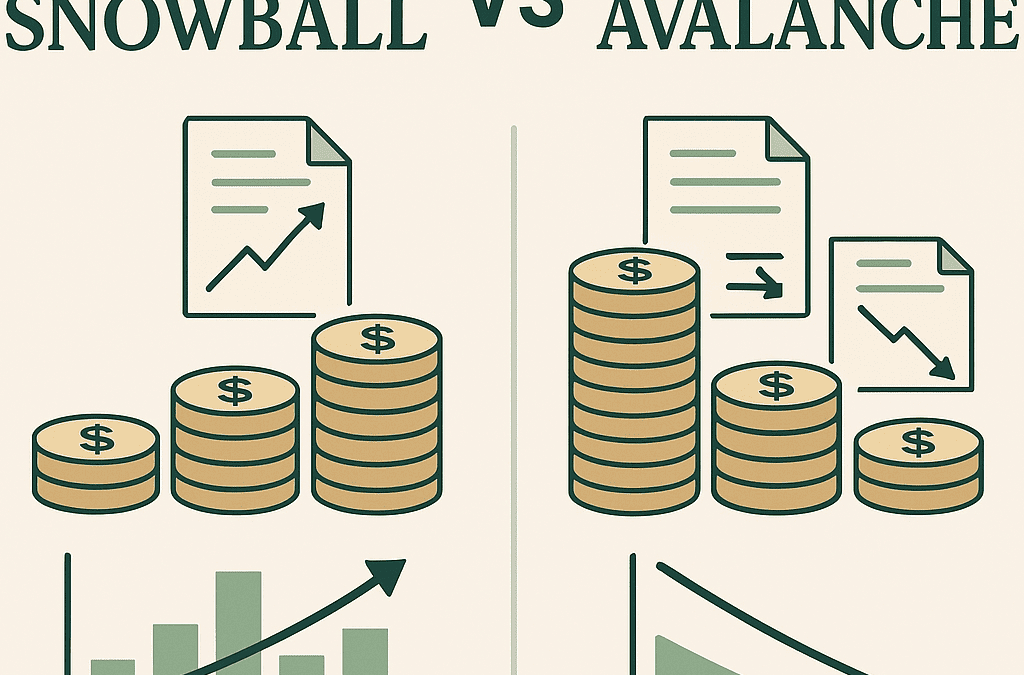

If you’re trying to pay off debt, you’ve probably heard of the Debt Snowball vs Avalanche methods. Both are powerful strategies—but which one works best for you depends on your mindset, goals, and financial habits. Let’s break them down.

What Is the Debt Snowball Method?

The Debt Snowball method focuses on paying off your smallest debts first, regardless of interest rates. Here’s how it works:

- List all your debts from smallest to largest.

- Make minimum payments on all debts.

- Put any extra money toward the smallest debt until it’s paid off.

- Move on to the next smallest debt—like a snowball rolling and gaining size.

Pros:

- Quick wins boost motivation.

- Encourages consistent progress.

Cons:

- May cost more in interest over time.

What Is the Debt Avalanche Method?

The Debt Avalanche focuses on interest rates instead of balances. Here’s how it works:

- List all debts from highest to lowest interest rate.

- Make minimum payments on all debts.

- Pay extra on the debt with the highest interest rate first.

- Once that’s gone, move to the next highest rate.

Pros:

- Saves the most money in interest.

- Pays off debt faster (in many cases).

Cons:

- Can take longer to see progress.

- May not be as motivating early on.

Which One Is Right for You?

It really depends on your financial personality:

- Choose Debt Snowball if you’re motivated by small wins and need momentum.

- Choose Debt Avalanche if you’re focused on saving the most money in the long run.

💡 Pro Tip: Some people even combine both methods—start with the snowball for motivation, then switch to avalanche once you build the habit.

Conclusion

Both the Debt Snowball and Avalanche methods can help you reach debt freedom. The key is consistency. Pick the method that fits your mindset, and stick to your plan!